For most Quebec homeowners, the property tax bill is one of the biggest annual expenses and one of the least understood. Behind every payment slip is a complex system of assessments, city budgets, and school funding rules that determine how much you owe and what services your money supports.

At Immovision, we believe homeowners deserve full transparency about how property taxes work and how they impact home values. In this article, we’ll unpack everything you need to know:

- What is Property Tax?

- How is Property Tax calculated?

- What does Property Tax pay for?

- How does Property Tax impact house prices?

What is property tax?

Property tax is an annual tax that homeowners pay to fund local public services. Put another way, it is how homeowners contribute financially to their community.

It’s based on your property’s assessed value. This is an estimate of what your home and land are worth, determined by your municipality’s assessment roll. Assessed value is not the same as market value or what you paid for your home.

The property tax has two main parts in Quebec (and most of Canada):

- Municipal tax

- School tax

Municipal tax is collected by your municipality to fund services like road maintenance, garbage collection, police, and fire protection. Meanwhile, School Tax is collected by your local school service centre (CSS) to fund the public education system.

You’ll usually receive two separate bills. One from your city, and one from your school service centre.

How is property tax calculated?

Property taxes are based on three things:

- The assessed value of your property

- The municipal tax rate set by your city

- The provincial school tax rate, which is standardized across Quebec

These three components are visible in the property tax formula:

Property Tax = (Assessed Value × Municipal Tax Rate) + (Assessed Value × School Tax Rate)

Let’s break this down, first looking at the properties assessed value.

1. Find your properties assessed value

Depending on where you live, it is either the municipality or your urban agglomeration that determines the assessed value of your property. This is done through an assessment roll (rôle d’évaluation foncière), usually updated every three years.

The assessed value represents the estimated market value of your property as of a specific reference date set by the municipality. It is not necessarily the same as the price you paid for the property or its current market value. You can find your properties assessed value by searching your address on your city’s website (e.g., Montreal, Laval, Longueuil, etc.). Links below.

- Montreal: “Rôle d’évaluation foncière” — city website Montréal

- Longueuil: Consult the 2025-2026-2027 assessment roll Ville de Longueuil

- Laval: Rôle d’évaluation foncière – Laval (2025-2026-2027): https://www.laval.ca/taxes-evaluation-fonciere/evaluation-fonciere/role-evaluation-fonciere/ Ville de Laval

- Brossard: Brossard’s evaluation service under the Longueuil agglomeration Brossard

For example, if you live in Greater Montreal, the City of Montreal’s Property Assessment Department prepares new assessment rolls for all 16 municipalities in the agglomeration.

To find your property, first you should visit the Check Property Assessment Rolls section of the website montreal.ca. Here you have a choice to check the rate in person or online.

Choose the online service and then enter the address of your property. Next click through the forms. On the final page of your search, you will find the “Values in the assessment role” (screenshot below).

As you can see below, this includes market reference date, land value, building value and value of the building.

- The land value is the value of the land that your property is built on

- The building value is the value of the building on the land.

- The value of the building is the building value plus the land value.

So, in the above example, the total assessed value is $351,900 and this was assessed on 2024-07-01, meaning that it is valid until 2027-06-30.

2. Find your municipal tax rate

Now that you know your property’s assessed value, the next step is to find your municipal tax rate. This is where things get a bit more complicated.

Most municipalities in Quebec set their own local municipal tax rates. However, if the municipality is part of an urban agglomeration, the central city (for example, Montréal or Longueuil) sets an agglomeration tax rate for shared regional services.

There’s one exception: if the municipality has reconstituted (become independent again after the municipal mergers), it can set its own local tax rate while still contributing to the agglomeration through a separate regional portion.

So, if you live in a reconstituted municipality, your total municipal tax rate is made up of two parts:

- A local municipal tax rate (e.g., set by Beaconsfield City Council)

- An agglomeration tax rate (e.g., set by the City of Montreal)

To find your current tax rate, visit the City of Montreal tax rate page and, if you live in a reconstituted municipality, check the rate on your city’s website.

- Beaconsfield municipal tax rate

- Westmount municipal tax rate

- Dorval municipal tax rate

- Côte-Saint-Luc municipal tax rate

Once you have your municipal tax rate, an example of the calculation you need to do is:

- If your assessed value is $500,000,

- and your city’s municipal tax rate is 0.70% (or $0.70 per $100),

- Then your municipal tax is:

$500,000 × 0.007 = $3,500

3. Check the school tax rate

Quebec has a single standardized school tax rate for everyone. This is currently 0.08423% for 2025–2026.

So:

$500,000 × 0.0008423 = $421.15

4. Add both amounts

If you revisit the property tax formula, you will see that the final step is to add the municipal amount together with the school tax amount. This is shown below.

Total Property Tax = Municipal ($3,500) + School ($421.15) = $3,921.15

5. The payment schedule

Now you know how property tax is calculated and what the total amount of property tax that you have to pay is. The next step is to determine the payment schedule. This is normally broken into two charges:

- Municipal tax: billed by your city (usually once per year, payable in one or two installments)

- School tax: billed by your school service centre (usually in July or August, covering 12 months)

The municipal tax is normally paid in the first half of the year, with most cities issuing the bill in January or February and setting due dates in March and June.

Whereas the school tax is typically paid between July and August, covering the period from July 1 to June 30 of the following year.

What does property tax pay for

Property taxes (municipal + school) are the lifeblood of local government services and infrastructure. In Montreal and elsewhere in Quebec, those funds go toward things like:

- Maintaining, repairing, or replacing roads, bridges, sidewalks, and underground infrastructure (water, sewers, storm drains)

- Investing in public transit, bike lanes, and active transportation networks

- Building or upgrading community centres, libraries, recreation facilities, and green spaces

- Paying for local public works, street lighting, traffic signals, snow removal, parks, waste collection

- Supporting utilities, drainage management, flood mitigation

- Covering administrative costs to run municipal departments that coordinate these services

Because these are large and long-lived assets, much of the money goes into capital projects, long-term maintenance, and renewal and not just short-term fixes.

Examples of notable Montreal constructions in the last 24 months

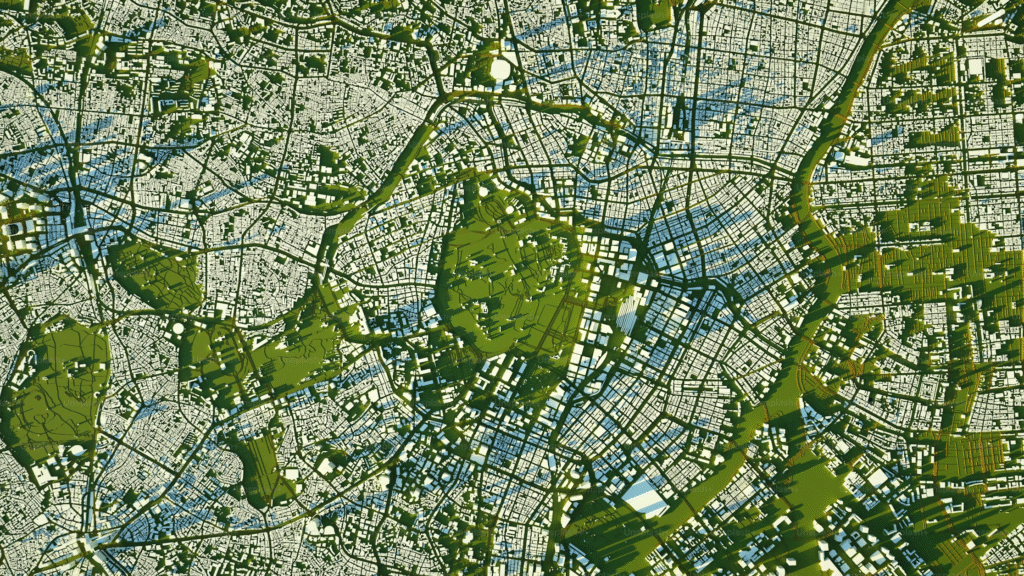

The City of Montreal contributes to 30% of the construction work done in the city. The city publishes a list of some of the most notable construction projects split by region (see image below).

On this page, you can see examples of notable Montreal construction projects in the last 24 months. Include investment into:

- A new bridge to connect Pont Jaques to Ile Bizard.

- The Namur-Hippodrome infrastructure

- Work Projects in Lachine

- Check out public works and major projects for more.

How does property tax impact house prices

Property tax impact house prices in several ways. For instance:

- Higher property taxes can reduce what buyers can afford

- But strong public services can increase house prices

- Sudden tax increases can slow the housing market

- Stable prices support price predictability

Let’s dive into each of these topics, as we consider how do property taxes impact house prices.

1. Higher property taxes can reduce what buyers can afford

When buyers assess how much they want to spend on the house, the consider the carrying costs, not just the mortgage. Property tax is one of the largest costs, along with insurance and utilities. Therefore, if property taxes are too high, the carrying cost also becomes too high. This will reduce the buyer’s maximum purchase price.

For example, if property taxes are $1,000 higher per year, that’s roughly equivalent to $20,000–$25,000 less in mortgage affordability (depending on interest rates). Over time, this can put downward pressure on home prices in areas with very high tax rates, since buyers factor those costs into their budgets.

2. But strong public services can increase house prices

High property taxes aren’t always bad for property values. If those taxes are visibly used for better schools, safer streets, good infrastructure, well-maintained parks and so on, they can actually support or raise home values.

For instance, neighborhoods with well-rated public schools and modern infrastructure often attract families, even if taxes are higher. This is because buyers see these areas as offering better long-term value and quality of life.

So in practice, whilst high taxes and low quality services can reduce property prices. High taxes and high quality of services can actually improve property prices.

3. Sudden tax increases can suddenly slow markets

If you are a real-estate investor, you already know that sudden tax increases can slow markets. This is because homeowners feel the financial squeeze and new buyers cannot afford to get into the market. Furthermore, pressure to sell among highly leveraged homeowners can lead to fire-sale conditions. This is something that we saw in Toronto in 2025, when the City of Toronto raised residential property tax rates by ~6.9 %.

4. Stable prices support price predictability

Buyers and investors value stability. Municipalities with predictable tax policy tend to see more stable home prices over time because buyers can plan their budgets confidently.

In contrast, regions with sudden or inconsistent tax hikes often see more volatility in both sales and prices.

Conclusion: Your Property Taxes Build the City Around You

Property taxes aren’t just numbers on a bill that comes in the mail. It reflects how a city funds its schools, infrastructure, and public services.

The rate you pay depends on your home’s assessed value, your municipality’s budget, and the province’s school tax rate.

By understanding how these pieces fit together, you can see the full story behind your property tax statement and not just what you owe, but how your money shapes the city that you live in. Whether you’re buying, budgeting or just curious, knowing how property tax works is one of the smartest ways to take control of your finances as a homeowner in Quebec.