Urban Agglomeration Definition

What are Urban Agglomerations in Quebec?

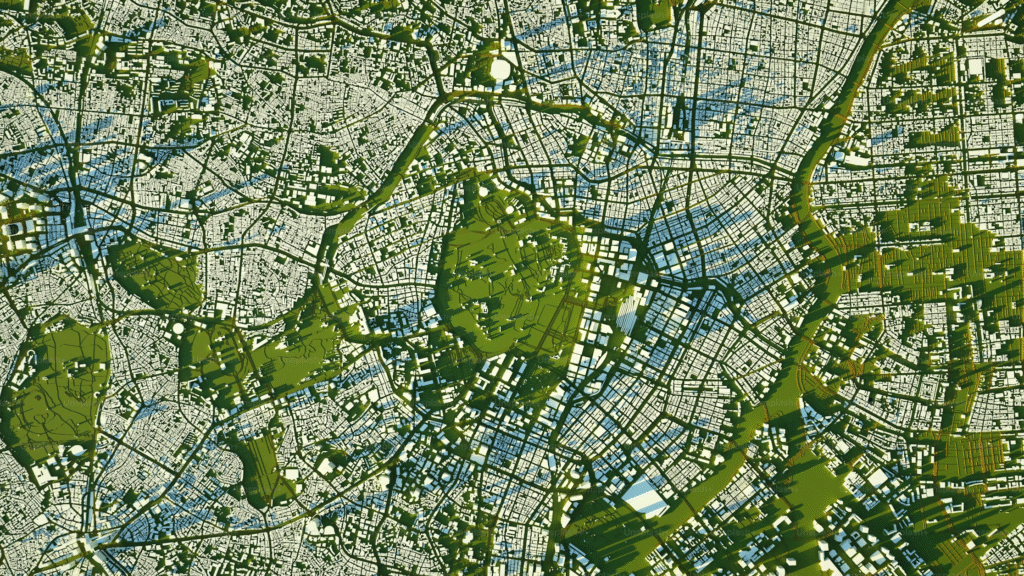

An urban agglomeration is an administrative division of Quebec made up of several neighbouring municipalities that jointly organize and fund certain essential public services such as police, fire protection, water and waste management.

One city, called the central municipality, is responsible for coordinating, managing and maintaining these shared services on behalf of the entire group, while the smaller related municipalities keep their own local councils for community-level matters like parks, permits and local roads.

For example, in Montréal, the Urban Agglomeration is made up of 15 municipalities that are managed by the Ville de Montréal, which acts as the central municipality.

For homeowners, this structure affects more than just how your garbage is collected. It directly shapes where your taxes go and what kind of infrastructure gets built in your area.

Why Urban Agglomerations Exist in Quebec?

The story of why urban agglomerations exist in Quebec starts with the situation before the early 2000’s.

Before the early 2000s

Before the early 2000s, most municipalities operated independently. This meant that they had full control over their own property taxes, zoning rules and local services such as water, fire protection, and waste collection.

For homeowners, this meant that your property tax rate depended entirely on the rules set out in your municipality. Buying a house one street over, in a different municipality, could mean a totally different tax bill or service level.

As a result of this independence, large differences between rich and poor municipalities materialized. For instance, Westmount collected some of the highest property tax revenues in Quebec and could afford premium local services like frequent snow removal and well-maintained parks, while neighbouring areas such as Montréal-Nord or Hochelaga-Maisonneuve struggled with lower tax bases and aging infrastructure.

2002 and the creation of Quebec’s “mega cities”

In 2002, the Government of Quebec (under Premier Bernard Landry) tried to consolidate these fragmented cities. Hundreds of small municipalities across Quebec were merged into large “megacities.” For example, Montréal swallowed up cities like Westmount, Beaconsfield, and Dorval. Longueuil absorbed Boucherville, Brossard, and others.

The impact this had on real estate was that municipal taxes (including property taxes) were gradually standardized across all municipalities within a single megacity. Money collected from wealthier areas was then pooled into a common fund and redistributed to support city-wide services and infrastructure, including in less affluent neighbourhoods.

The idea behind this initiative was to build a more balanced region where property prices would gradually equalized across neighbourhoods. However, the initiative saw strong resistance in wealthy suburbs like Westmount and Beaconsfield, where many homeowners felt their tax dollars were being used to subsidize other parts of the island. Campaigns like the “Hands Off My City” movement, led by Westmount’s mayor Peter Trent, became a rallying point for residents who opposed the mergers and fought to regain municipal independence.

2006 demerger and a partial re-merger

After a change in government, residents of many former cities were allowed to vote to de-merge. Fifteen municipalities on the Island of Montréal chose to regain independence (e.g., Westmount, Beaconsfield, Côte-Saint-Luc, and Dollard-des-Ormeaux).

However, de-merging created a new problem around who should pay for shared services like police, fire, water, and waste that everyone still depended on?

To fix this problem, Quebec passed Bill 75 in 2006 (otherwise known as the Act Respecting the Exercise of Certain Municipal Powers in Certain Urban Agglomerations). This is the law that created the current day Urban Agglomerations in Quebec. Now, municipal taxes would be collected from residents of the municipalities and a portion of these would then be allocated to the Urban Agglomeration, whilst another portion would be allocated to the local municipality.

For real-estate owners, this means that when you pay your property taxes, part of your money stays with your local city to fund neighbourhood-level services like parks, permits, and local roads while another part is transferred to the central city (for example, Ville de Montréal) to cover island-wide services such as police, fire protection, and water management.

In practical terms, even if you live in an independent municipality like Westmount or Beaconsfield, a portion of what you pay still goes into Montréal’s agglomeration budget, which is managed and voted on by the Agglomeration Council. The result is a system that blends local independence with shared financial responsibility across the region.

Who Gets Your Property Tax Dollars in an Urban Agglomeration?

A study by the inter-university research centre CIRANO showed that 90% of the contribution quotas (payments) by municipalities are determined by the distribution of richesse foncière (i.e. property wealth) among member municipalities.

This money is collected through your Property Taxes. Part of this is used for infrastructure projects in your own municipality and the other part is paid to the agglomeration and used for city wide initiatives and shared regional services.

The amount of money that is paid by each municipality inside the urban agglomeration is dependent on three things:

- Property wealth (total property value within that municipality)

- Population (number of residents)

- Usage of shared services

For example, in the Urban Agglomeration of Montreal, Beaconsfield has fewer residents but higher property values than say Montréal-Nord. Therefore, even though it’s smaller, Beaconsfield pays a higher share per person toward the agglomeration.

This is why Beaconsfield and other de-merged cities often complain about how much they have to pay since they pay heavily for services largely controlled by Montreal, with limited say in how the money is spent.

List of Quebec’s Urban Agglomerations and their constituent municipalities

- Urban agglomeration of Montreal (administered by the Montreal Agglomeration Council)

- Ville de Montréal

- Ville de Baie-D’Urfé

- Ville de Beaconsfield

- Ville de Côte Saint-Luc

- Ville de Dollard-Des-Ormeaux

- Ville de Dorval

- Ville de Hampstead

- Ville de Kirkland

- Ville de L’Île-Dorval

- Ville de Montréal-Est

- Ville de Montréal-Ouest

- Ville de Mont-Royal

- Ville de Pointe-Claire

- Ville de Sainte-Anne-de-Bellevue

- Village de Senneville

- Ville de Westmount

- Urban agglomeration of Quebec City

- Ville de Québec

- Ville de L’Ancienne-Lorette

- Ville de Saint-Augustin-de-Desmaures

- Urban agglomeration of Longueuil

- Ville de Longueuil

- Ville de Boucherville

- Ville de Brossard

- Ville de Saint-Bruno-de-Montarville

- Ville de Saint-Lambert

- Urban agglomeration of Mont-Laurier

- Ville de Mont-Laurier

- Municipalité de Saint-Aimé-du-Lac-des-Îles

- Urban agglomeration of La Tuque

- Ville de La Tuque

- Municipalité de La Bostonnais

- Municipalité de Lac-Édouard

- Urban agglomeration of Les Îles-de-la-Madeleine

- Municipalité des Îles-de-la-Madeleine

- Municipalité de Grosse-Île

- Urban agglomeration of Sainte-Agathe-des-Monts

- Ville de Sainte-Agathe-des-Monts

- Municipalité d’Ivry-sur-le-Lac

- Urban agglomeration of Mont-Tremblant

- Ville de Mont-Tremblant

- Municipalité de Lac-Tremblant-Nord

- Urban agglomeration of Cookshire-Eaton

- Ville de Cookshire-Eaton

- Municipalité de Newport

- Urban agglomeration of Rivière-Rouge

- Ville de Rivière-Rouge

- Municipalité de La Macaza

- Urban agglomeration of Sainte-Marguerite–Estérel

- Ville de Sainte-Marguerite-du-Lac-Masson

- Ville d’Estérel